RE/MAX NATIONAL HOUSING REPORT Q1 2022

Rising Interest Rates Impact Housing Market Activity

Following a season of unprecedented sales volumes, activity within the South African Housing market has begun to subside, most likely as a result of the interest rate hiking cycle that started in November last year.

According to Lightstone Property data, a total of 36,685 bond registrations were recorded at the Deeds Office over the period January to March 2022. The RE/MAX National Housing Reports reveal that this figure is down 33% on Q1 2021’s figures. The number of transfers (both bonded and unbonded) recorded at the Deeds Office for the first quarter amounted to 52,241*. This amount is down by 9% on last quarter and down by 30% YoY.

Of the 52,241 transfers, a total of 26,170* freehold properties and 13,737* sectional title units were sold countrywide (these figures exclude estates, farms, and land only transfers). The number of freehold properties registered decreased by 30% YoY and by 7% QoQ. Sectional titles decreased by 31% YoY and by 9% QoQ.

Regional Director and CEO of RE/MAX of Southern Africa, Adrian Goslett, explains that this decline was inevitable and is not necessarily cause for concern. “Activity within the property market increased largely as a result of the record-low interest rates that we enjoyed since Q2 2020, which is why it was expected that activity would subside as soon as interest rates climbed,” he states.

Dip in Average House Prices

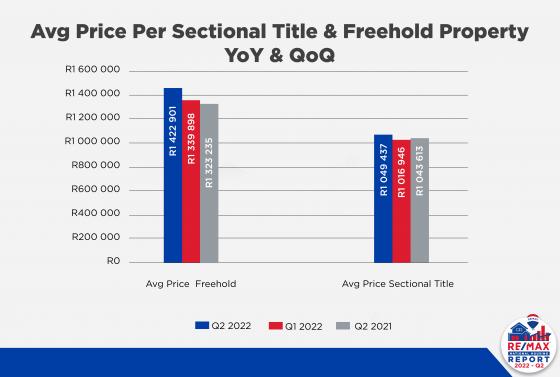

According to Lightstone Property data, the nationwide average price of sectional titles for Q1 2022 is R1,0161,946* which, when reviewed against the figures from previous RE/MAX National Housing Reports, is a decrease of 1% YoY and 2% QoQ. The nationwide average price of freehold homes is R1,339,898* which, when reviewed against the figures from previous RE/MAX National Housing Reports, is a 6% increase YoY but a 3% decrease when compared to last quarter.

According to Lightstone, year-to-date, the Average Price Changes per annum for sectional titles is down by 2% and 3% down for freehold properties. The Average Active RE/MAX Listing Price for the fourth quarter amounted to R3,291,021.53. This is a 6% increase QoQ and a 1% decrease YoY.

“The property market works in cycles, which is why real estate is designed to be a long-term investment so that the highs will balance out the lows. Real estate remains such a high-yielding investment strategy when approached in this way,” Goslett comments.

Lightstone Property data also reveals that the average bond amount granted during this period amounted to R1,315,000. The RE/MAX National Housing Reports reflect that this is an increase of 7% YoY. “With the average bond amount climbing, my only caution is that buyers leave room in their budget to make allowances for the coming interest rate hikes,” says Goslett.

Activity remains consistent within price brackets

Minor movement can be seen but no substantial changes occurred within the sales volumes between the various price segments. Sales priced between R800,000 and R1,5 million continue to account for the largest portion at 26.2%* of all transfers occurring in Q1 2022. Following this figure were transfers priced below R400,000 which now account for 24.2%* of all transfers in Q1. Moved out of its second-place position last quarter, transfers between R400,000-R800,000 now follow in third place close behind the previous segment at 23%* of the total transfers. Sales between R1,5 million to R3 million accounted for 19.5%* and those priced above R3 million accounted for 7.2%* of the total transfers this quarter.

Market Performance Per Province

In terms of the performance of the RE/MAX of Southern Africa network, higher volumes of sales occurred in KZN (29% up from the same period last year) & Eastern Cape (1% up), while sales volumes for the rest of the regions are down. This is in line with greater market trends that reflect a decline in sales volumes across the country.

The top five searched suburbs on remax.co.za were as follows:

- Bloubergstrand, Western Cape – 3400 searches

- Parklands, Western Cape – 3368 searches

- Sunningdale, Western Cape – 3064 searches

- Fourways, Gauteng - 2634 searches

- West Beach, Western Cape – 2603 searches

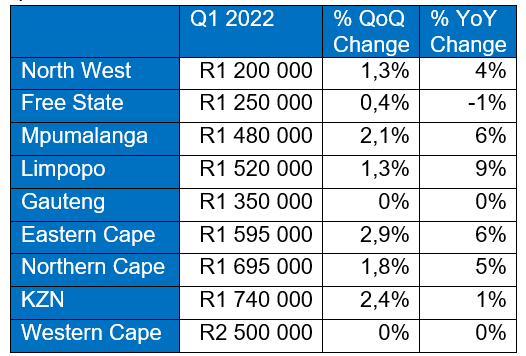

According to Private Property, the median asking price per province of active listed stock on Private Property for Q1 2022 were as follows:

** Disclaimer: The data reflected herein represents data that is voluntarily obtained from subscribers from the Private Property South Africa’s website and is based solely on data collected by Private Property South Africa (Pty) Ltd. Further, the data reflected herein is accurate as per the Private Property South Africa database dated 05 July 2021. Reliance on such data is at the sole discretion of subscribers and Private Property South Africa hereby indemnifies itself of any consequence of such reliance.

Final thoughts

“For every season of hyperactivity (like the one we have just experienced), a season of gradual decline will inevitably follow. Whether we now face a season of gradual decline remains to be seen. But, for as long as interest rates continue to climb, it seems probable that activity will decline along with every interest rate hike. This may present opportunities for buyers who can afford the higher financing repayments, as a decrease in buyer demand will result in lower asking prices. But, every suburb will have its own set of trends that may or may not reflect greater housing market trends. Those who are curious to find out how the market is performing in their area should speak to their local real estate professional for some insights,” Goslett concludes.

*Figures according to Lightstone Property

Send to a Friend